cap and trade vs carbon tax canada

On March 25 th 2021 the Supreme. On the other hand political economy forces strongly point to less.

What Is Canada S National Carbon Tax And How Does It Affect Us Futurelearn

The price of the carbon is determined by assessing the cost of damage associated with each unit of pollution and the cost of controlling that pollution Grantham.

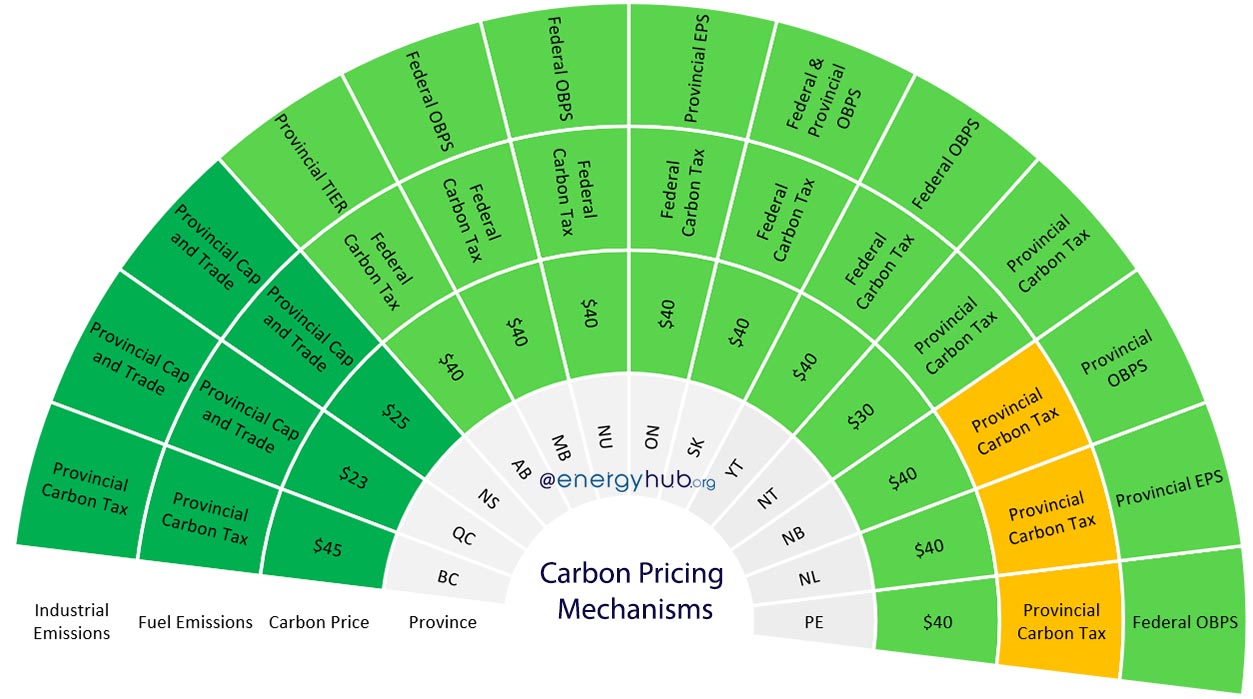

. The Canadian Government stated that by 2030 the carbon tax will rise to 170 a ton from 50 per ton in 2022. Quebec and Nova Scotia use cap-and-trade systems and Newfoundland and Labrador will raise its price to 50 a tonne later in 2022. With a tax you get certainty about prices but uncertainty about emission reductions.

In 2016 the federal government announced that all provinces and territories must put a price on carbon pollution. Carbon Tax vs. A cap-and-trade system through provi - sion for banking borrowing and pos - sibly a cost-containment mechanism.

An annual 15 increase. The carbon tax is a financial measure of the actual cost of greenhouse gases and its impact on the economy Carbon Tax or Cap-and-Trade 2014. It seems inevitable that some day Congress will pass legislation meant to cut.

Carbon Tax vs. By Jordan Cheung Americas Asia Europe Mar 11th 2022 4 mins. A Carbon Tax vs Cap-and-Trade.

Economists usually prefer taxation over. Carbon tax has always been viewed by many countries as a useful and. Future energy historians will likely point to November 7.

Provincial fuel charge federal OBPS. -Like the Cap-and-Trade system a Carbon Tax can be structured such that 100 percent of the money is returned directly to the people who are taxed-A Carbon Tax. Stavins1 Harvard Kennedy School This paper compares the two major approaches to carbon pricing carbon.

You can tweak a tax to shift the balance. Theory and practice Robert N. Carbon pricings costs and benefits to.

By Brian Schimmoller Contributing Editor. The Canadian Chamber of Commerce has released an economic paper titled A Carbon Tax vs Cap-and-Trade analysing the two systems of. They can use a carbon tax a cap-and-trade program or a blend of the two.

With a cap you get the inverse. Carbon taxes vs. Provincial carbon tax and OBPS.

April 9 2007 413 pm ET. Cap-and Trade vs Carbon Tax.

The World Urgently Needs To Expand Its Use Of Carbon Prices The Economist

Australia Repeals Carbon Tax Developed Nation Australia The European Union

Canadian Carbon Prices Rebates Updated 2021

Pin By Yvonne Williams On Canada Oh Canada Cap And Trade Gas Prices The Province

Difference Between Carbon Tax And Emissions Trading Scheme Carbon Cap And Trade United States Vacation

Climate Change Not Looking So Hopeless A Map Of Climate Change Policies Around The World Link To Pdf Of Source Report In Comments Climate Change Policy Climate Change Climate Policy

Bless You 22 Minutes For This Beautiful Gift Hotline Bling Dance Canadian Things

Carbon Tax Pros And Cons Economics Help

Pin On Politics Policy And Media

Cap And Trade Vs Taxes Center For Climate And Energy Solutionscenter For Climate And Energy Solutions

Canary In The Coal Mine Birds Predict Change In Sask Boreal National Observer Coal Mining Boreal Forest Bird Species

Where Carbon Is Taxed Overview

Climate Change And Carbon Tax Impact On The Economy Deloitte Insights

Where Carbon Is Taxed Overview

Cap And Trade Vs Carbon Tax Earth Org