who claims child on taxes with 50/50 custody canada

The amount for Childs Fitness and Arts. If parents have 5050 parenting time but one parent contributes significantly more financials that parent may get to claim the child ren a greater percentage for example 2 out of 3 years.

Co Parenting How Child Support And Shared Custody Affect Your Taxes The Official Blog Of Taxslayer

Typically when parents share 5050 custody they alternate.

:max_bytes(150000):strip_icc()/GettyImages-549470003-cf4cb275ec61486d9112cfc1d0907964.jpg)

. Tax law mentions custodial and noncustodial parents but does not mention joint physical custody or 5050 custody. The maximum amount for a child under six is 6765. Its never an even 5050 split.

In a joint custody agreement the custodial parent can claim the child as a dependent on their tax returns. The IRS has put rules in place to make tax filing fair for parents who have 5050 custody. Jackass whose getting away with not paying for the child or your sister because shes.

However if the child custody agreement is 5050 the IRS allows the parent with the. The 78-year-old didnt immediately go see a doctorpartly due to. The only exception to this is if the court says otherwise or if the custodial parent signs a form called the Release of.

When parents share parenting time equally 5050 one of the two parents must have at least one more overnight than the other because there are an odd number of days in a year 365. The custodial parent as defined by the IRS claims the child tax credit in a 5050 division. The federal government also offers child tax credits.

You must meet the following qualifications to claim. Heres what it does say. Credit for other dependents.

For this to be possible you and the childs other parent must pay for at least 50 of the childs expenses and have an existing custody order. Im not a tax or legal pro so this is just my personal experience. One person paying child support.

Parents can also come to a mutual agreement regarding which of them will claim the child when filing for taxes. Parents Can Decide Who Will. For children age 6-17 the maximum amount is 5708.

Childrens fitness and arts amounts. For a confidential consultation with an experienced child custody lawyer in Dallas. Both these amounts can be claimed by either parent as long as the total amount thats being claimed is not more than the maximum allowed.

There are 365 days a in a year. Usually this amount can be claimed by either parent. Shared custody can create a situation where one parent gets to claim the child as a dependent.

The parent claiming the child for the tax year will be able to claim all of these. Secondly Im not sure who is truly the idiot. The custodial parent can waive their.

If you make child support payments for a child and the other parent does not you cannot claim an amount for an eligible dependant for that child. Answer 1 of 6. Under IRS tiebreaker rules theyd be entitled to claim the child as a dependent assuming your equal custody arrangement remains in place.

Claiming one or more dependents on your taxes can yield some valuable tax benefits including the ability to claim the child tax credit and the child and dependent care tax. Deciding who can claim a child on taxes with 5050 custody can be tricky if youre not aware of the IRS rules. Basically the custodial parent claims the dependent child for tax benefits.

Additional child tax credit. In the joint custody case both parents have the right to claim this amount. The following arrangements were written into Joint Parenting Agreements during mediation prior to.

Divorce In Michigan The Legal Process Your Rights And What To Expect Schaefer Esq John F 9781940495293 Amazon Com Books

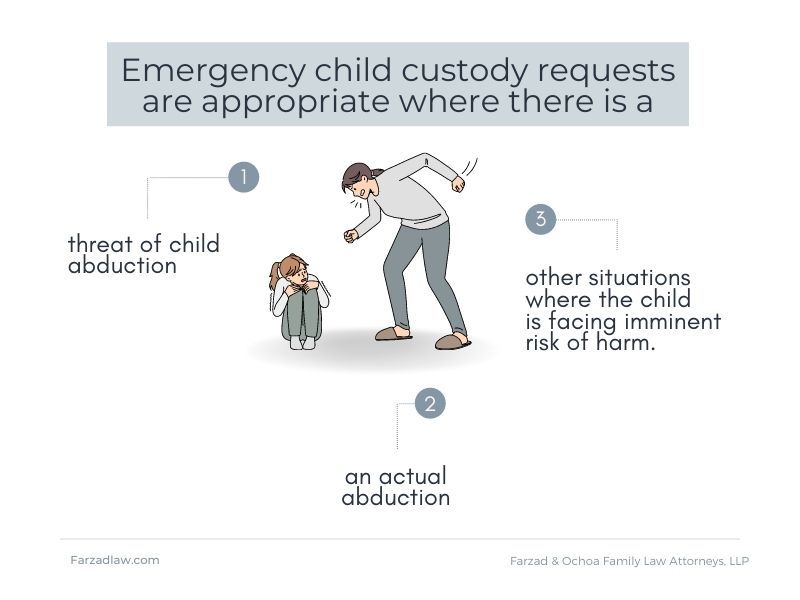

California Child Custody Laws Written By Experts California Child Custody Attorneys Farzad Ochoa

The New Monthly Stimulus Checks For Families How Do You Get Them And When

A Brief Guide To The Child Tax Benefit In Canada

How Do You Claim A Child On Taxes With 50 50 Custody

Who Claims The Child On Taxes With 50 50 Custody Denver Co

Obtain A Move Away Order California A People S Choice

:max_bytes(150000):strip_icc()/what-if-someone-else-claimed-your-child-as-a-dependent-14afba0c76f846a1a86345d929b455e8.jpg)

Irs Tiebreaker Rules For Claiming Dependents

Who Claims The Child On Taxes With 50 50 Custody Denver Co

Claiming Dependents On Taxes In Canada Who Is Eligible

Who Claims Taxes On Child When There S 50 50 Custody

How Do You Claim A Child On Taxes With 50 50 Custody

Tax Tips For Separated Parents Who Claims Child Care Expenses

How Single Parents Can Save Thousands On Taxes

I Have Shared Custody Of My Child Should I Get Monthly Child Tax Credit Payments Kiplinger

Over 30 Proven Ways On How To Win A Child Custody Case In California

Federal Child Support Guidelines A Comprehensive Review Volume 1 Children Come First A Report To Parliament Reviewing The Provisions And Operation Of The Federal Child Support Guidelines

Tax Tips For Separated Parents Who Claims Child Care Expenses